Banks’ deposits with CBN jump 16 times on CRR

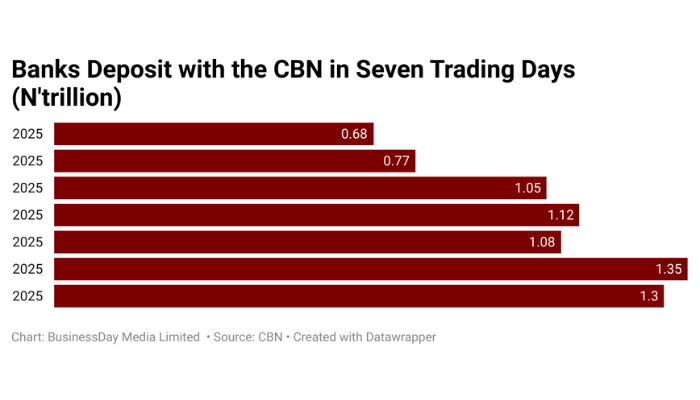

Nigerian commercial banks have significantly increased the volume of overnight deposits placed with the Central Bank of Nigeria (CBN), as their use of the Standing Deposit Facility (SDF) surged more than 15-fold within a year.

Data from the apex bank revealed that deposits through the SDF skyrocketed by 1,549.36 percent or 16 times to N38.76 trillion as of May 6, 2025, compared to N2.35 trillion on May 7, 2024.

This dramatic increase has been attributed to a combination of elevated Cash Reserve Ratio (CRR), abundant liquidity in the financial system, subdued demand for credit, risk-averse lending behaviour by banks, and the CBN’s tight monetary policy stance.

Read also: Five charts show how Nigerian banks performed in Q1

In a notable policy move in September 2024, the CBN raised the CRR for commercial banks by 500 basis points to 50 percent from 45 percent, while the CRR for merchant banks was increased to 16 percent from 14 percent.

The CRR represents the portion of a bank’s total deposits that must be held in reserve with the CBN, earning no interest. This measure is used to control the money supply and curb inflationary pressures. As liquidity within the system increased, banks with limited lending opportunities and cautious outlooks opted to deposit excess funds with the central bank to mitigate risk.

CBN data showed that on April 24, 2024, banks placed as much as N1.8 trillion with the CBN in a single day, while the lowest recorded deposit year-to-date was N33.62 billion as of March 24, 2025. Analysts say this reflects not only ample liquidity but also a significant pullback in risk-taking among banks.

Tilewa Adebajo, chief executive officer of CFG Advisory, noted the impact of monetary tightening on banking behaviour. “The increase in banks’ deposit with the CBN is the direct result of the 50 percent CRR. Inflation management is the priority,” Adebajo said.

He noted that the immediate effect of this policy stance is a lack of credit and liquidity constraints, which ultimately dampen economic growth.

“More needs to be done on the fiscal side, with structural reforms and support from monetary policy to reduce inflation to 2013–2014 levels, where inflation was 11 percent, interest rates at 13 percent and the economy growing at eight to 10 percent,” he added.

Banks careful of creating loans

Ayokunle Olubunmi, head of financial institution ratings at Agusto & Co., also weighed in on the issue, explaining that the trend reflects stronger liquidity positions among banks but also highlights a cautious approach to lending amid economic headwinds. “This reflects the improving liquidity of the banks. Unfortunately, given the challenges in the economy, the banks are a bit careful about creating loans,” he said.

At the same time, borrowing by deposit money banks from the CBN under the Standing Lending Facility (SLF) rose by 22.6 percent, reaching N54.29 trillion as of May 7, 2025, up from N44.29 trillion on the same date in 2024. While this suggests some banks still seek short-term funding, it is overshadowed by the much larger surge in SDF usage, indicating a broader liquidity surplus.

Despite the cautious stance, banks’ credit to the private sector recorded a modest year-on-year increase of 6.8 percent, rising to N76.26 trillion in March 2025 from N71.43 trillion in March 2024. However, the month-on-month growth was negligible at just 0.01 percent, up marginally from N76.25 trillion in February 2025.

In contrast, commercial banks’ credit to the government expanded significantly, rising by 28.9 percent to N25.85 trillion in March 2025, compared to N20.05 trillion a year earlier. On a monthly basis, however, lending to the government declined by 4.6 percent from N27.11 trillion in February.

Over the past five years, the CBN has pursued a sustained tightening cycle, pushing the monetary policy rate (MPR) from 11.50 percent in 2021 to 27.50 percent as of March 2025. The bulk of the adjustment occurred within the last year alone, with the MPR rising by an unprecedented 875 basis points as the CBN intensified efforts to combat inflation.

Read also: Customers to pay more as banks raise SMS alert by 50%

These efforts have shown mixed results. Inflation, which was 24.48 percent in January 2025, eased slightly to 23.18 percent in February, only to edge up again to 24.23 percent in March. The rebound in inflation suggests that underlying price pressures remain stubborn, despite aggressive policy measures by the CBN.

Earnings’ growth by banks

Meanwhile, commercial banks have posted strong earnings in spite of the challenging operating environment. The pre-tax profit of five Tier-1 banks climbed by 69.5 percent to N4.56 trillion in 2024, compared to N2.69 trillion in 2023. Net profit after tax rose by 66.2 percent, from N2.27 trillion to N3.78 trillion over the same period, underlining the banks’ ability to maintain profitability despite regulatory and economic headwinds.