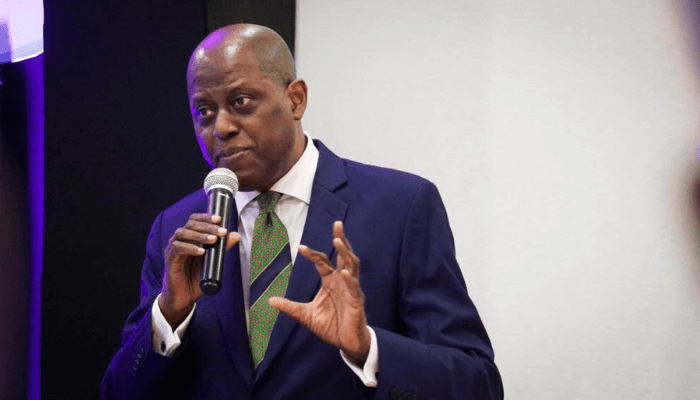

Cardoso says reforms fuelling naira stability, competitiveness

Olayemi Cardoso, governor, Central Bank of Nigeria (CBN), said on Tuesday that the naira has become more stable and competitive following a series of early and sustained monetary and fiscal reforms that helped shield the economy from recent global financial turbulence.

Speaking to journalists in Abuja after the Monetary Policy Committee meeting, Cardoso outlined progress in rebuilding investor confidence and shoring up Nigeria’s external buffers.

He emphasised that the recent upgrade by Fitch Ratings, coming amid heightened global uncertainty, signals recognition of Nigeria’s economic turnaround efforts.

Read also: Nigerian firms see naira, interest rate rise over the next six months

Last month, Fitch Ratings upgraded Nigeria’s credit rating to’B’, from ‘B-‘, indicating a stable outlook, which reflects increased confidence in the government’s broad commitment to policy reforms implemented since its move to orthodox economic policies in June 2023, including exchange rate liberalisation, monetary policy tightening and steps to end deficit monetisation and remove fuel subsidies.

According to Cardoso, “The Fitch upgrade, which came during a period of significant global economic headwinds, makes it even more meaningful.

“It is a very positive signal, especially when you consider the uncertainty around global trade, interest rates, and capital flows.”

Outlining CBN’s policy logic, Cardoso explained that investors are averse to unstable environment, noting that, “with stability comes confidence, with confidence comes investment, and with investment comes growth and output.”

He stated that recent disinflationary trends, declining exchange rate volatility, and strengthened reserve positions all point toward a stabilisation of Nigeria’s macroeconomic fundamentals.

According to him, the exchange rate volatility which has dropped from over four percent a year ago to under 0.5 percent demonstrates a real measure of monetary stability.

Also, recent moves, including monetary tightening and improved coordination with fiscal authorities, have restored calm, he noted.

In response to questions about Nigeria’s resilience in the face of global market uncertainty, Cardoso said Nigeria’s currency held up far better than many peer economies in recent months.

Read also: Naira gains further after CBN launch of non-resident BVN

“We are in a period of heightened global tension, and currencies around the world have been under attack,” he said. “But Nigeria came out well engaged. Our depreciation was modest, and our reforms allowed us to build buffers that absorbed the shocks.”

Cardoso credited the CBN’s forward-looking strategy for averting worse outcomes. “If those actions had not been taken when they were, the results would have been far more damaging,” he said.

The governor further pointed to a significant jump in net external reserves—from just over $3 billion to about $23 billion—as evidence of improved market confidence.

Gross reserves is now in excess of $38bn, well above the IMF’s six-month import cover benchmark.

“These figures didn’t just happen,” Cardoso told journalists. “They reflect transparency in process, policy consistency, and reforms that encouraged players who had been sitting on the sidelines to return to the market.”

He also highlighted improvements in Nigeria’s trade balance and current account, with a surplus supported by lower import demand and rising gas exports.

He further noted that domestic fuel importation had declined, with the Dangote refinery and others coming onboard —a development expected to ease pressure on FX demand.

Read also: How naira devaluation is reshaping Nigeria’s economy

Addressing investor confidence directly, Cardoso stressed that the CBN is rebuilding credibility step by step.

“We are on a mission to restore confidence and build back trust. We want all stakeholders to know they are dealing with a Central Bank that will not disappoint.”